the rating agency Standard & Poor’s reduced on 1 March the prospect of credit rating of Mexico, of the Federal Commission of electricity and Petroleos Mexicanos (Pemex) from stable to negative.

According to the release of the rating agency, the baja in the perspective of Mexico is due to a possible poor economic growth, greater centralization in decision-making that may affect macroeconomic stability and the lack of confidence of investors before the cancellation of the new airport. This triggered a debate among Secretaries of State, opposition and even the President about the alleged motives of S & P to issue the qualification.

Read: Rating initiative faces Senators of Morena: Monreal rejects proposal for the party but be, what means lower it in perspective? What are the rating and what measure?

Rating agencies are companies dedicated to evaluate the capacity of payment of a debtor. I.e., how likely is that who contracts a debt meets his payment commitments. Debtors may be federal, State, municipal governments or companies.

There are multiple rating in the world, but the most important are Standard & Poor’s, Fitch and Moody’s, says José Antonio Romero Tellache, Professor-researcher of the center of economic studies of the College of Mexico.

Arrays of the major rating agencies are located in United States. However, they have regional branches authorized by the legislation of each country to inform the degree of risk of failure to comply with the commitment to pay a debt to matrices.

Read: Rating the country punished by neo-liberal policy that was a failure: AMLO according to Joel Martínez, director of financial Viewer, there is a date which periodically rating agencies conduct an evaluation.

How calculated is the financial capacity of the debtor?

The criteria rating agencies use are income and present and future expenses. With flows of income and expenditure of the present and future, the rating agency makes an assessment of the possibilities of payment of the debtor.

Rating agencies create financial models, which make growth assumptions of the variables that affect the income of entities that qualify.

For example, rating agencies considered that the resources destined for Mexico to replace the bond of the airport, after its cancellation, will not generate resources in the future.

Read: Standard & Poors down Pemex rating perspective negative low performance of the rating agencies placed the entities in a particular step. For example, there are eleven steps for Moody’s. The highest are Aaa, Aaa1, Aaa2, Aaa3, A1, A2, A3, and the lowest C. S & P and Fitch, the highest echelons are AAA, AA + and AA and the lowest NR. S & P has 25 steps and Fitch with 28.

The decrease in a step means that there is a greater likelihood that a Government fails to meet its payment commitments. However, Arturo Antón, Professor – researcher at the Economics Division of the center of investigation and economic teaching (CIDE) explained that the increase in the probability is relatively small.

On the rating scale, there is a level called investment grade. On the Moody’s scale is investment grade Baa3 step and S & P and Fitch, BBB-scale.

If an entity is found in the highest degree of the step, away from investment grade, it means that it is highly likely that it will comply with its commitments. But if the entity is situated just above investment grade, the probability of default is greater.

Mexico is located in step A3 by Moody’s (3 steps above investment grade) and the step BBB + from S & P and Fitch (2 above investment grade).

Mexico has maintained the same rating from S & P since December 2013, Fitch and Moody’s since February of 2014 from may 2014.

PEMEX, fell to Fitch investment grade in January of 2019 and is located in the step of Moody´s from March 2016.

According to the rating agency Fitch, the fall in the credit rating was due to the close link of Pemex the Government, reduction of investment and low production.

What is the change in perspective?

The change in perspective, means, according to Romero, a warning. In other words, if the entity continues to present the same hazards identified by the rating agency, lower step.

The fall in the credit rating is not immediate, usually takes about 6 months to a year, according to said Martinez. S & P said in the statement on the change of perspective of Mexico from stable to negative, that the probability of a low rating for next year is “one in three”.

Read: S & P reduced Mexico’s stable rating Outlook to negative; expected economic growth under the entity can contribute to changing the perspective of credit rating through a commitment to prudent fiscal performance and policies that generate certainty among investors.

According to the Bank of Mexico, in 2016 agencies changed the perspective of Mexico from stable to negative, growth below expectations, growing public debt and uncertainty regarding the renegotiation of the Treaty of free Trade. However, the Federal Government promised to modify its monetary and fiscal policies and the perspective in 2017 was adjusted back to stable.

What happens when there is a decrease in the rating?

The low rating reflects the risk and level of skepticism that perceives a rating. It is not per is a guarantee that the economy will go wrong, said an expert of the financial market.

Given that the decrease in the rating means a greater probability of default of the debtor, the investor charged a higher interest rate to lend money. I.e., it will be more expensive for the entity to find someone who will lend him money.

This situation can affect private companies, according to Anton and the financial expert, since it also discourages investment.

By mandate, funders may not invest in entities that are below investment. When an entity falls below investment grade the financier has to sell the bond debt.

Who is responsible in the decline of a rating or change of perspective?

According to Anton, a credit rating change is the responsibility of administrations past and present. Rating agencies issued a rating based on the assessment of the current state, of income and expenditure of the past, and the future of the debtor. Therefore, the current status of income and expenditure of the past depend largely on political and economic decisions carried out in the past, and future spending and revenues depend to a greater extent of plans and programmes which are expected to carry out the mourner r. change in perspective is usually done based on the updated information of the income and expenses of the debtor, and the change of the present and future decisions, so it is the responsibility of who is in the mandate.

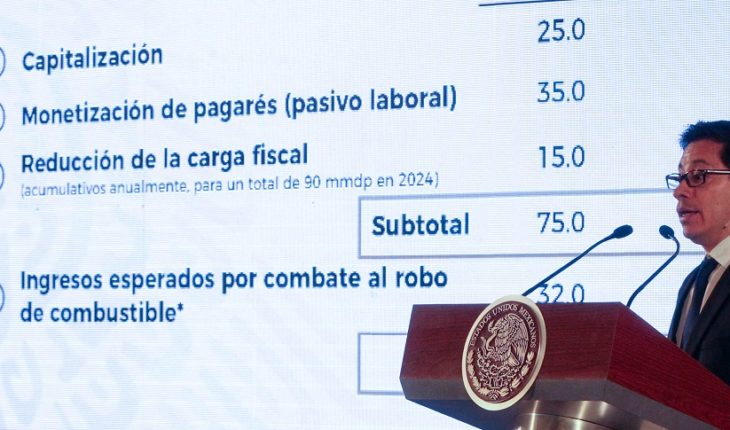

MARTINEZ said that, in the case of Pemex, the current Government inherited debt and insufficient cash flow situation to keep oil exploration. However, corresponds to the current Administration to respond how to receive resources to deal with the situation of the company, and change the Outlook from negative to stable.

Thanks for reading! Help us to continue with our work. How? You can now subscribe to political Animal on Facebook. With your monthly donation, you will receive special content. Find out how to subscribe here. Check our list of frequently asked questions here.

translated from Spanish: What are the rating and how do their valuations?

March 11, 2019 |