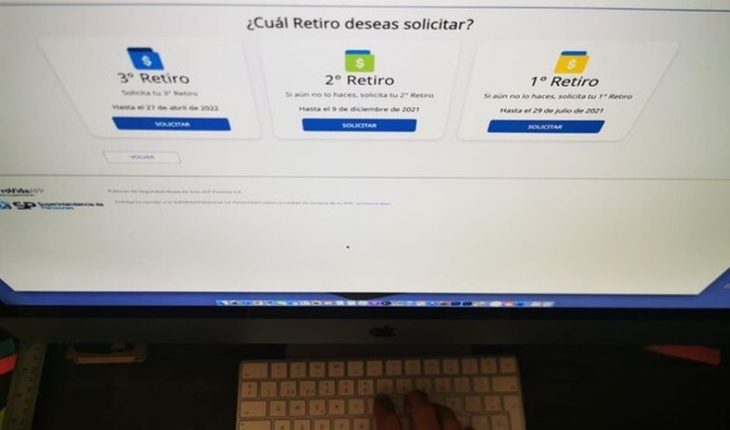

Through a letter addressed to the authorities, the AFP Association warned about the consequences that the approval of the fourth withdrawal of pension funds could entail and they call not to do so. The letter states that “in recent times we have seen how the pension future of the country’s workers is put at risk as a result of successive withdrawals of savings destined for pensions. The value of the pension savings accumulated with the effort of each of the members and pensioners, already begins to show the damage that was previously profusely warned, both by us and by experts and economic authorities of all sectors. ” The warnings gave way to the evidence. And these are alarming. The profitability figures of the most conservative funds in the pension system, those that invest in a greater proportion in instruments of the local market, are deteriorating since the beginning of this year, a trend that is sharpening in the current month of October, “he adds. And they say that “never, in the 40 years of history that the pension system has in Chile, has there been such a large fall in local debt securities as the one registered this year. It did not happen with the external debt crises in 1982-1985; nor did it happen with the Asian Crisis of the years 97-98; nor with the attack on the Twin Towers in New York in 2001; neither with the invasion of Iraq, nor with the international financial crisis of 2008, nor with the one generated by the pandemic in 2020,” they point out. In the letter they also maintain that the 5,786,672 members who today are building their savings in funds C, D and E, along with some 653,000 pensioners who also have their pensions in these multifunds, “will see their pension savings fall during October due to the impact on successive retirements. The AFP states that “it is important to emphasize that each successive withdrawal does greater damage than the previous one. The first withdrawal had limited effects for two reasons: it was thought to be unique and the Central Bank helped to accommodate it gradually. Once the second withdrawal is approved, the situation quickly worsens; the negative impact of the third party is even greater. Now, the possibility of a fourth withdrawal has been anticipated by the market, transforming an already serious situation into a critical situation.”

AFP association warned that “each withdrawal does greater damage than the last”

October 21, 2021 |