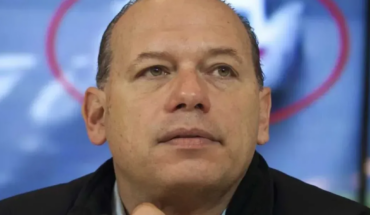

According to a report prepared by First Capital Group (FCG), credit card operations reached $ 2,322,124 million in February, an increase of only 1.4% over the previous month, well below expected inflation. Year-on-year growth climbed to 82.6%, also below inflation for the period. The fall is even more significant if one takes into account that the month of February is usually the one with the highest card spending due to the beginning of the school period and the purchases that this entails. “We are witnessing a really significant drop in the balances of financing in this area. February should be the month during which the credit limits are more outdated because the increases in the parity have not yet been reflected in the salary receipts and because the Banking Entities have not put in place the mechanisms to review them, “explained Guillermo Barbero, Partner of FIRST CAPITAL GROUP. However, financing balances in this area are very low, indicating that credit limits have not yet been updated to reflect wage increases and accelerated inflation. ̈The acceleration of the pace of inflation makes it necessary to update credit limits more frequently to maintain the level of cardholder spending. It is striking that the beginning of the school year, and the purchases that this causes, are not reflected in a more important growth of balances, “said Barbero.Regarding the use of credit cards for purchases in dollars, in February they registered a year-on-year increase of 17.2%, although with an irregular monthly behavior. In February there was an increase of 12.3% over the previous month. “Travel abroad has reactivated this item but the application of differential exchange rates for the use of the card in foreign currency limit its use and today it is at values well below those usual in pre-pandemic times,” he closed.

Credit card consumption fell sharply in February

March 6, 2023 |